georgia estate tax calculator

An estate tax is a tax imposed on the total value of a persons estate at the time of their death. 083 of home value.

Your Statesboro Ga Real Estate Questions Answered

If you need to find your propertys most recent tax assessment or the actual property tax due on your property.

. Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but. For comparison the median home value in Fulton County is 25310000. Title insurance is a closing cost for purchase and refinances mortgages.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. Forest Land Property Property that qualifies can be assessed at its current use value rather than fair market value when the property is primarily used for the good faith subsistence or.

Our Chattooga County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Georgia and across the entire United States. Tax amount varies by county. It is sometimes referred to as a death tax Although states may impose their own estate taxes.

Georgia is ranked number thirty three out of the fifty states in order of the average amount of. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Our Georgia tax calculator is incredibly user-friendly and easy to navigate all you need to do is enter the following information.

We will resume normal business hours Monday November 14. Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd Resurgens. Counties in Georgia collect an average of 083 of a propertys assesed fair market value as property tax per year.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle. Use Ad Valorem Tax Calculator. Standard Homestead Exemption The home of each resident of Georgia that is actually occupied and used as the primary residence by the owner may be granted a 2000 exemption from.

This calculator can estimate the tax due when you buy a vehicle. Our Georgia Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. Once the tax has been paid the clerk of the superior court or their deputy will attach to the deed instrument or other writing a certification that the tax has been paid.

To use the calculator just enter your propertys current market value such as a current appraisal or a. Seller Transfer Tax Calculator for State of Georgia. Adjusted gross income AGI Zip code.

The real estate transfer tax. Easily estimate the title insurance premium and transfer tax in Georgia including the intangible mortgage tax stamps. You are able to use our Georgia State Tax Calculator to calculate your total tax costs in the tax year 202223.

For comparison the median home value in Richmond. All state offices including the Department of Revenue will close on Friday November 11 for the Veterans Day holiday.

Georgia Property Tax Calculator Smartasset

Is There An Inheritance Tax In The Usa Expat Tax Professionals

Barrow County Georgia Tax Rates

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

:max_bytes(150000):strip_icc()/beautiful-old-couple-619409150-d7a3f4b5f2874a55a0195b8c53d9d3b9.jpg)

Calculating Your Potential Estate Tax Liability

New York State Enacts Tax Increases In Budget Grant Thornton

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Does Your State Have An Estate Or Inheritance Tax

Estate Taxes Will The Stepped Up Basis Be Eliminated Bankrate

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

Estate Tax In The United States Wikipedia

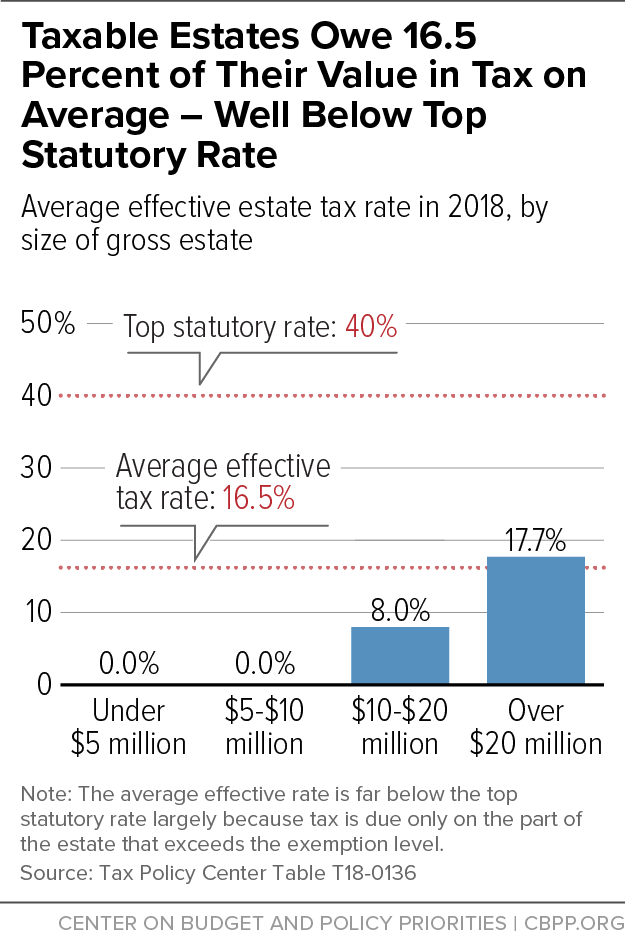

Policy Basics The Federal Estate Tax Center On Budget And Policy Priorities

What Are The Costs Associated With Selling A Home In Georgia Brian M Douglas

Individual Income Taxes Urban Institute

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro